VAT for European Customers

For customers in the European Union, Linkly is required to collect Value Added Tax (VAT) to comply with European tax laws.

Most businesses in the EU are not required to pay VAT upon presentation of a valid EU VAT number.

How to Add a VAT Number to your Linkly Account

1

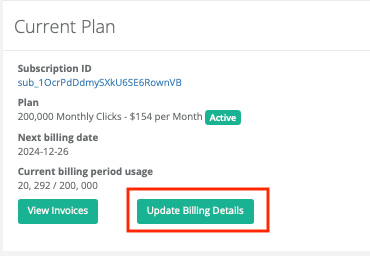

Go to Settings in the sidebar, then click Billing

2

Click Update Billing Details

Click Update Billing Details

3

Under Billing Information, click Update Information

Under Billing Information, click Update Information

4

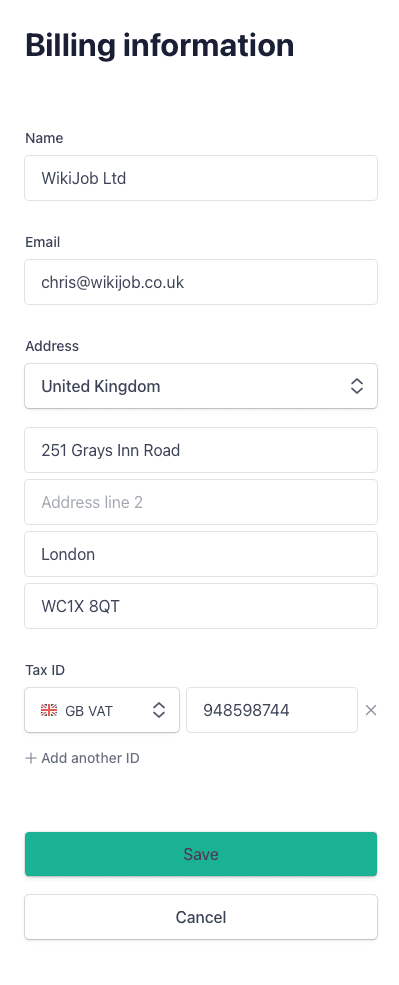

Make sure the business name and VAT number are present

Make sure the business name and VAT number are present

Frequently Asked Questions

I'm not registered for VAT, do I need to pay VAT?

Yes. We are required to charge VAT in the European Union.

I have provided a VAT number but I have already been charged VAT

We are unable to modify invoices and charges after they have been issued.

You are entitled to claim any VAT charged through your VAT return.